Pioneer Bancorp, Inc./MD (PBFS)·Q4 2025 Earnings Summary

Pioneer Bancorp Reports Record Year as Loan Growth Hits 15%, Launches Broker-Dealer

January 30, 2026 · by Fintool AI Agent

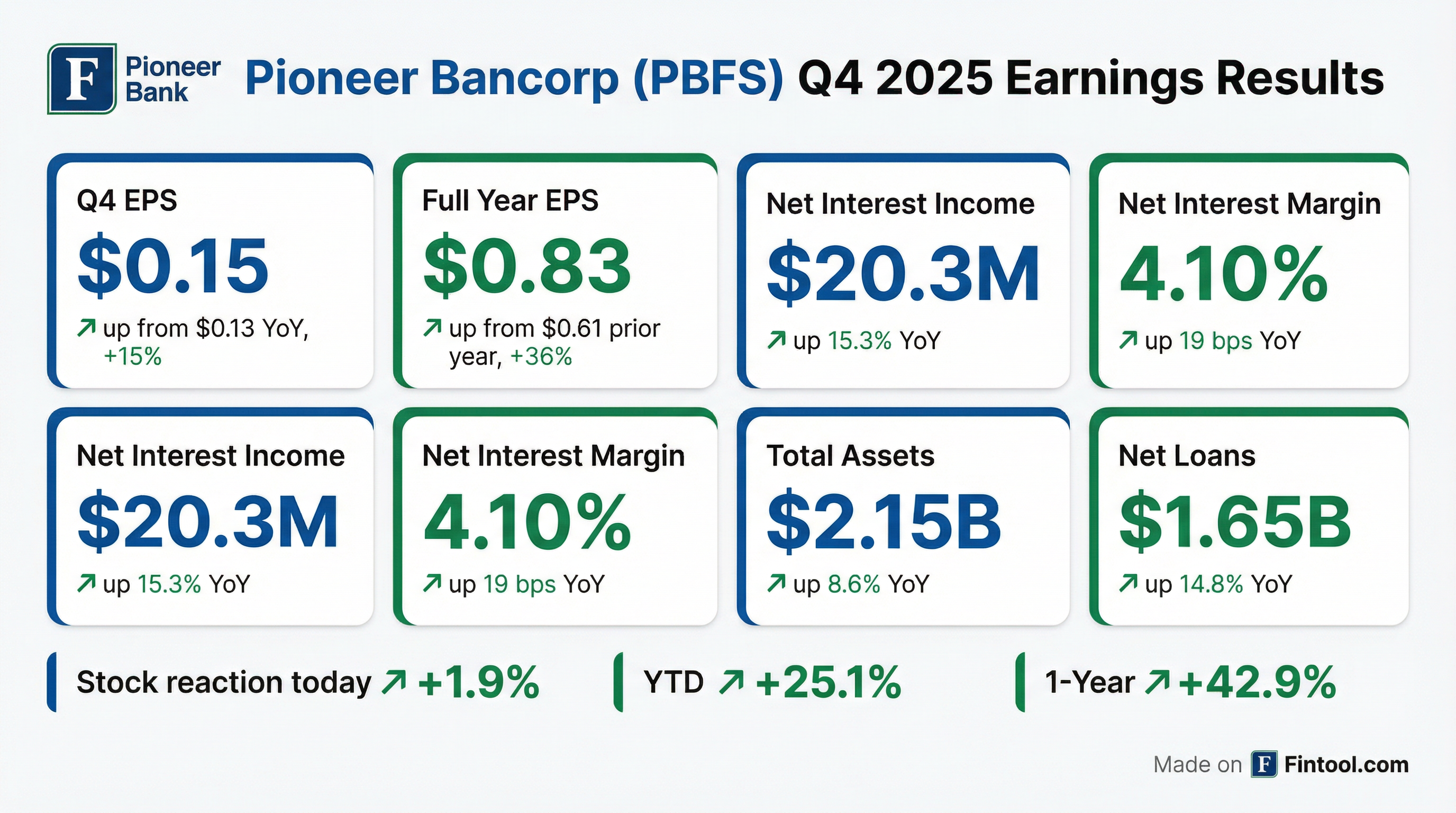

Pioneer Bancorp (NASDAQ: PBFS) delivered solid Q4 2025 results with net income of $3.7 million ($0.15 diluted EPS), up 15% from $3.3 million ($0.13 EPS) in Q4 2024 . For the full calendar year 2025, net income reached $20.3 million ($0.83 EPS), a 36% increase from the $15.3 million ($0.61 EPS) reported for fiscal year 2024 . The Capital Region community bank also announced the launch of its broker-dealer subsidiary and completion of a major wealth management acquisition.

What Were the Key Financial Highlights?

Pioneer reported record net interest income driven by robust loan portfolio expansion and disciplined margin management :

Full year 2025 net interest income reached $79.1 million, up $12.6 million or 19.0% from the prior fiscal year .

How Did the Stock React?

PBFS shares rose 1.9% to $14.15 on the earnings release date, extending a strong run that has seen the stock gain 25.1% year-to-date and 42.9% over the past year. The stock is trading near its 52-week high of $14.94 and well above its 52-week low of $10.60.

What Did Net Interest Income and Margin Look Like?

Net interest margin expanded 19 basis points to 4.10% for Q4 2025, and 29 basis points to 4.07% for the full calendar year . The improvement came from:

- Higher asset yields: Average yield on interest-earning assets increased 30 bps to 5.78% for Q4 2025 vs Q4 2024

- Growing loan book: Average balance of interest-earning assets increased $181.9 million

- Controlled funding costs: Average cost of interest-bearing liabilities only rose 6 bps to 2.49%

Interest expense increased 18.2% to $8.1 million for Q4 2025 due to repricing of deposits and a shift toward higher-cost interest-bearing accounts .

What Was the Balance Sheet Position?

The balance sheet showed strong growth across key categories :

Loan growth by segment :

- Residential mortgages: +$104.1M

- Commercial real estate: +$51.6M

- Commercial construction: +$38.7M

- Commercial & industrial: +$16.4M

- Home equity: +$2.7M

- Consumer: +$1.6M

The deposit base remained well-diversified: 53.9% retail, 20.1% commercial, and 26.0% municipal relationships . Estimated uninsured deposits (net of affiliate and collateralized deposits) represented just 16.6% of total deposits .

What Strategic Initiatives Were Announced?

Pioneer advanced its "More Than a Bank" strategy with three key developments :

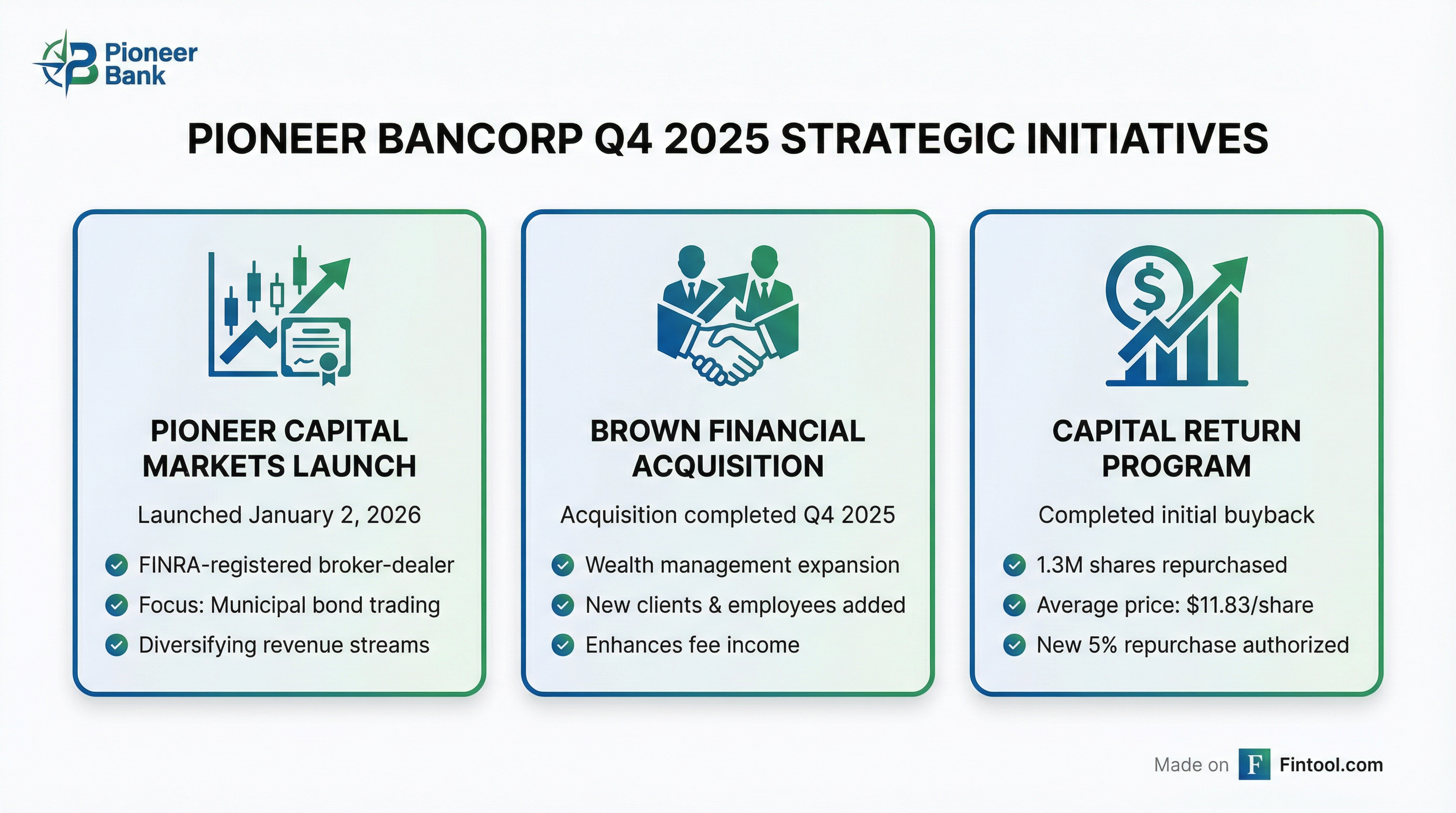

1. Pioneer Capital Markets Launch On January 2, 2026, Pioneer's newly established broker-dealer subsidiary commenced trading operations with an initial focus on proprietary trading of investment grade municipal bonds . This marks Pioneer's entry into regulated broker-dealer operations.

2. Brown Financial Acquisition Pioneer completed the acquisition of Brown Financial Management Group during Q4 2025, expanding its wealth management capabilities .

3. Stock Repurchase Program Pioneer completed its initial buyback program, repurchasing 1,298,883 shares (~5% of outstanding) at an average price of $11.83 per share . A new program to repurchase up to 5% of outstanding shares (1,254,027 shares) was authorized on December 17, 2025 .

What Did Management Say?

CEO Thomas Amell highlighted the strong year and strategic progress :

"Our results for the year ended December 31, 2025 were solid and underscore Pioneer's continued commitment to our relationship based operating model, which drives strong client advocacy through our highly engaged employees. We experienced positive momentum for the year, highlighted by record net interest income driven by strong growth in our loan portfolio and diversified deposit base, while prudently managing funding costs."

On the strategic vision :

"During the fourth quarter, we continued to advance our strategic vision of being 'More Than a Bank.' We completed the acquisition of Brown Financial Management Group, and we are pleased to welcome their clients and employees to Pioneer... Looking ahead, our focus remains on delivering long-term value for our stockholders, customers, and employees."

What Were the Credit Quality Metrics?

Asset quality showed some deterioration but remains manageable :

The increase in non-performing assets was primarily due to a $4.7 million commercial real estate loan relationship (four loans secured by office, warehouse, and industrial properties) placed on non-accrual status . However, net charge-offs remained minimal at 0.01% of average loans annualized .

The provision for credit losses was $3.7 million for the full year 2025, up from $2.7 million in the prior fiscal year, primarily due to loan portfolio growth .

What Impacted Noninterest Income and Expense?

Noninterest income increased 5.0% to $17.1 million for the year, driven by growth in insurance and wealth management services income .

Noninterest expense increased 8.8% to $66.1 million for the year, primarily due to :

- Higher salaries and employee benefits from merit increases and share-based compensation

- A $2.0 million goodwill impairment charge related to the insurance subsidiary

- Increased litigation-related expenses

The effective tax rate rose to 23.4% for the year (29.7% for Q4 2025) compared to 21.4% in the prior fiscal year, primarily because the goodwill impairment is not deductible for tax purposes .

What Are the Capital Ratios?

Pioneer Bank maintains strong regulatory capital well above "well capitalized" standards :

The decline in risk-based capital ratios reflects the strong loan growth, which increased risk-weighted assets.

What Should Investors Watch Going Forward?

Positives:

- Record net interest income with margin expansion despite rate cuts

- Strong loan growth across residential and commercial segments

- Diversification into broker-dealer operations for fee income

- Continued capital return via new buyback authorization

- Well-capitalized with strong liquidity

Concerns:

- Non-performing assets more than doubled YoY, particularly in commercial real estate

- $2.0 million goodwill impairment signals challenges in insurance subsidiary

- Rising operating expenses outpacing revenue growth

- Capital ratios declining as loan growth accelerates

Note: Pioneer Bancorp is a small-cap community bank (~$355M market cap) with no analyst coverage, so beat/miss data versus consensus estimates is not available.

Related Links: